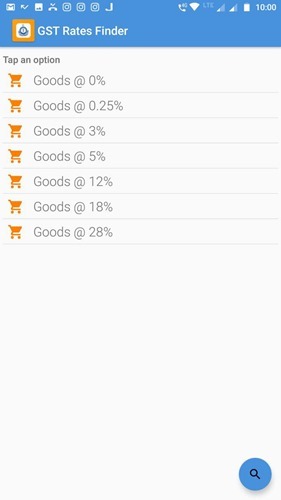

Indian government have implemented a new tax system named “The Goods and Services Tax” or GST from 1st of July 2017. GST have mainly 5 types rates 0% (products like Milk, Eggs, Salt etc.), 5% (Sugar, Tea, Coal etc.), 12% (Computers, Mobiles, processed food etc.), 18% (Printers, Soap, etc.) and 28% (Small cars, High end Motor cycles etc.). There are two other rates 0.25% for rough precious and semi-precious stones and 3% on gold.

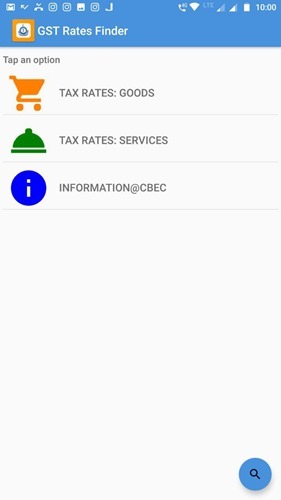

After switching into the GST from earlier Tax system there are so many confusions about the rates for each products. To reduce the confusions Government (Central Board of Excise and Customs) have released an Android application named GST Rate Finder. This simple application will help a user to find products under a specific GST slab or one can search for a product to find under which GST rate it comes into.

Home screen

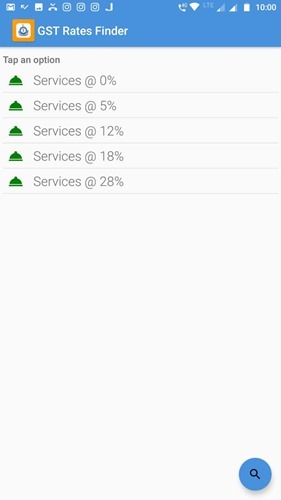

GST for Services

GST for Goods

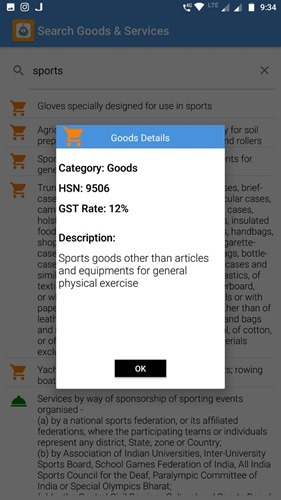

GST details for a specific product

If you are interested you can get the GST finder from this link