Recently Indian government informed all PAN card holders to connect their PAN(Permanent Account Number) with the Aadhaar to avoid fake accounts. Income tax department deactivated 11.44 lakh PAN accounts too. So is your card in that list? here is how you can check it. This same method can be taken if you have forgot your pan card number too. We have earlier covered What to do if you lost your PAN card and forgot the PAN number

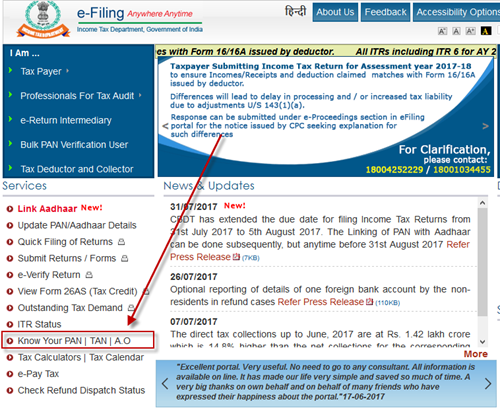

1. Open https://incometaxindiaefiling.gov.in

2. on the left hand side click Know your PAN (or open https://incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourPanLinkGS.html)

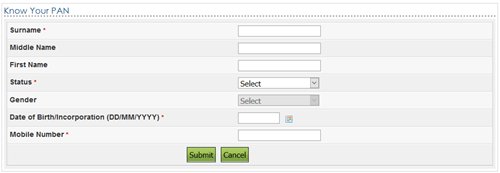

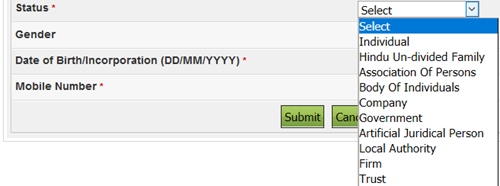

3. Enter the Details (Surname, Status, Date of birth and Mobile number are mandatory fields)

Status will be Individual

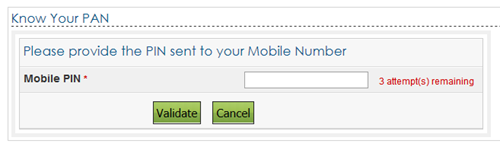

4. After submitting you will receive an SMS with One time password (OTP) enter it on the next screen

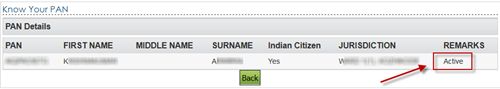

5. Next screen you will see the details of your PAN card, check the Remarks section to know it is Active or not

If you don't know how to connect your PAN card with Aadhaar

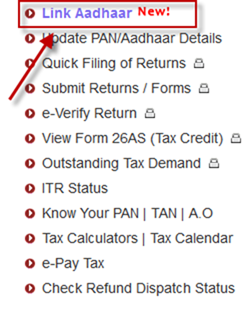

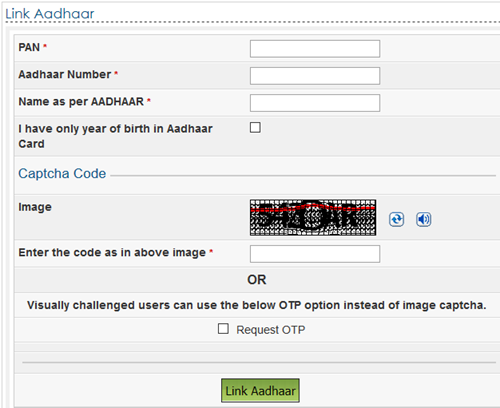

1. Visit https://incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html (If this does not work, click https://incometaxindiaefiling.gov.in and click “Link Aadhaar”)

2. Enter PAN, Aadhaar, Name on Aadhaar and Captcha

3. Submit it

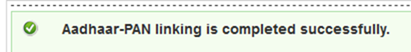

It is really easy